What A Year: 45 Fossil Fuel Disasters The Industry Doesn't Want You To Know About | ThinkProgress

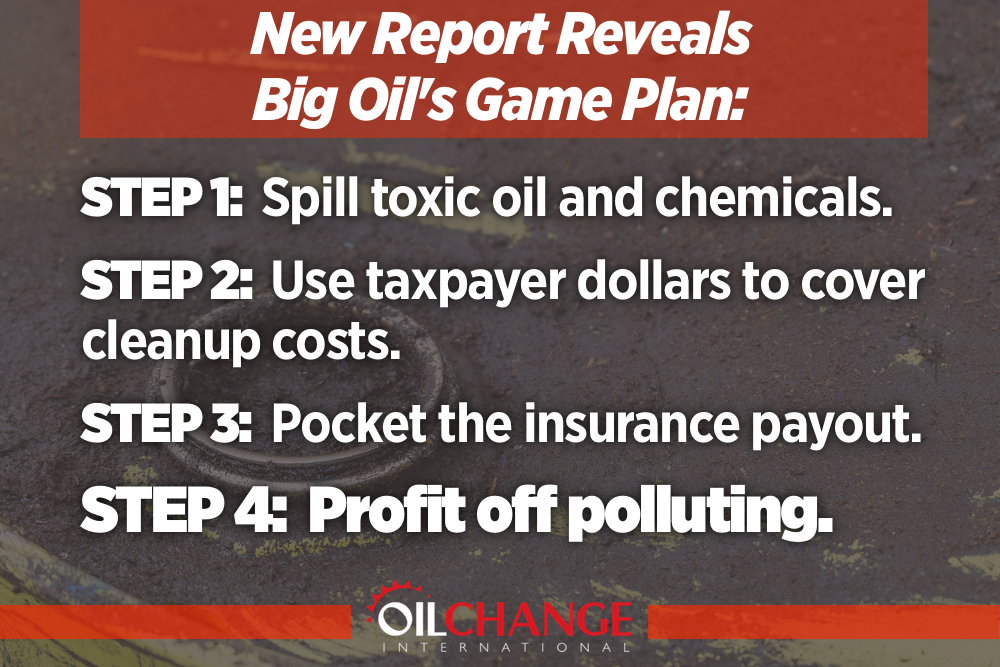

Offshore and Onshore Rigs

January 22: A Devon Energy natural gas rig in Utah

catches fire, causing evacuations for half a mile radius of the rig. No injuries are reported.

July 7: A

hydraulic fracturing operation at a gas well drilling pad in West Virginia explodes and injures seven people, four with potentially life-threatening burns. The explosion occurred while workers were pumping water down a well, part of the hydraulic fracturing process for recovering gas trapped in shale rock. The tanks that recover the water and chemical mixture after they return to the surface are what reportedly exploded.

August 28: A “well-control incident” at an oil drilling rig in rural south Texas causes an “

intense” explosion after workers were drilling horizontally into the Eagle Ford Shale, causing homes to be evacuated. No injuries reported.

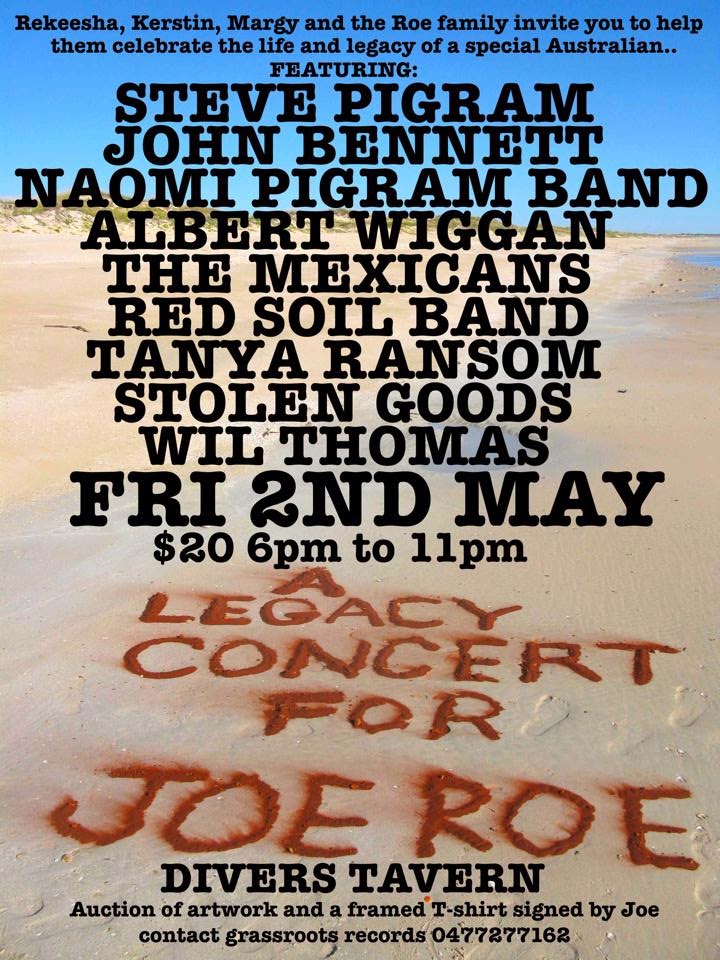

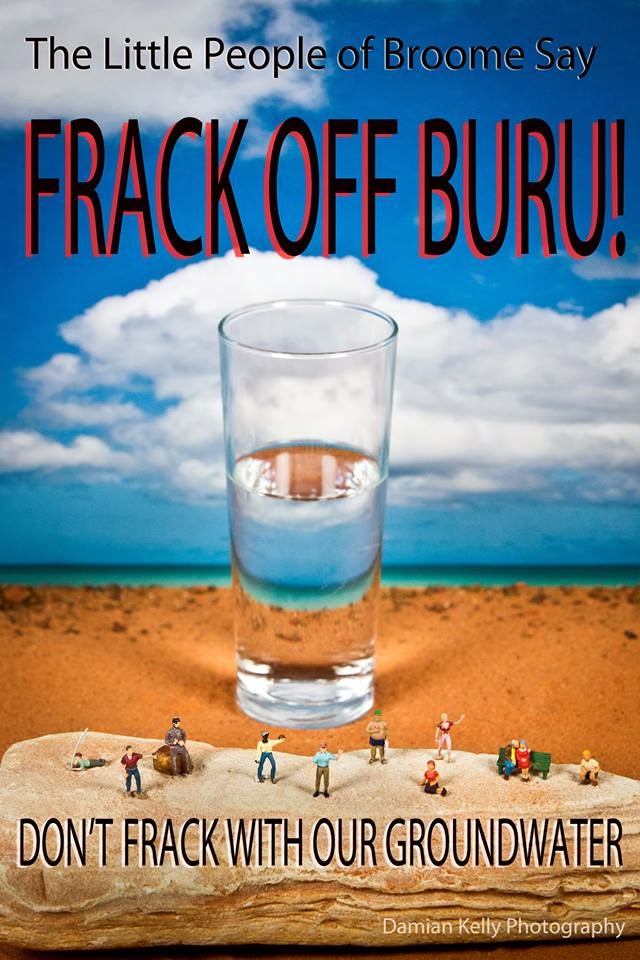

Photo Damian Kelly

Photo Damian Kelly

Oh my God!! This was dangerous. The explosion occurred while workers were pumping water down a well, part of the hydraulic fracturing process for recovering gas trapped in shale rock.

ReplyDeleteRegards,

Komatsu Parts

YEP SH*T HAPPENS !

ReplyDeleteSemi-submersible Drilling Rig Sinks at DSME [INCIDENT PHOTOS

http://gcaptain.com/odfjell-drilling-rig-sinks-dsme/

The Deepsea Aberdeen, a semi-submersible drilling rig being built for Odfjell Drilling, sank at the DSME shipyard in South Korea on Saturday.

Up until its sinking at the pier, the Deepsea Aberdeen, a GVA7500-design semi-submersible was due for delivery in May 2014 and set to be relocated to the harsh environment West of Shetland on a long term contract for BP. With an unknown amount of water damage, that schedule now appears questionable.

“The rig has sunk and lies on the seabed by the quay. It is not submerged,” said Tor Henning Ramfjord, chief executive of National Oilwell Varco Norway.

Ramfjord said 38 employees of his company were on the rig at the time of the accident. All were safe, he said.

Update: The rig has since been refloated. The following images come from an anonymous gCaptain contributor.

This is a potentially significant setback for both Odfjell and BP as this particular rig had a 7-year, $1.2 billion contract attached to it. Odfjell notes this is the largest contract they have ever been awarded.

There have been no reports of injuries associated with this accident.

More sh*t happening.

ReplyDeleteLeviathan grows as Woodside's enigma

...........buying into a region with the political undercurrents of the Middle East was never going to be smooth sailing. When Woodside bought in, the partners were looking to access its expertise in liquefied natural gas projects.

Even though Israel is close enough to regional markets such as Turkey and Egypt to be able to pipe gas economically, a year ago relations between these countries were fraught. Hence the open door to Woodside, since the project would need access to more distant markets if it was to proceed.

What a difference a year makes.

Now, Israel's relations with Egypt have warmed up following a change of government, as have relations with Turkey, so that pipeline options are back on the table.

In the process, the prospective role for Woodside may have dwindled, leading to recent talk in Israel that Woodside will walk. That may be premature, although finalising any Woodside participation has slipped back until some time in the first half of 2014.

Along with sorting out the scale, and the priorities, of the proposed development, another stumbling block has been the tax regime for gas exports, which will not be sorted out for another month or two.

Given the lack of information from Woodside - which appears to be largely due to the unsettled state of the partners, coupled with the time it is taking for the government to resolve issues relating to the venture - shareholders are becoming twitchy over the status of its proposed participation.

Analysts argue Leviathan is really ''a long-dated growth option''.

''With one year having passed since the initial farm-in, the fact that there appears progress on Israeli fiscal terms could be seen by some investors as a slight positive,'' was the way RBC Capital Markets put it in a recent note. However, ''investors are increasingly eager for more clarity around plans for Leviathan''.

In this regard, recent comments by the main shareholder, Noble Energy, which has a 40 per cent stake, that a staged development is on the cards was the first clear information about what is going on. Included in these options is piping the gas, which will lift prospective returns as well as throw up a range of development options.

For Woodside, the issue now is whether it will take part in the entire project, including any pipeline, or be limited to the proposed liquefied natural gas portion only.

Complicating any decision is the 20 per cent increase in the size of the known resource which, with the improved economics from any pipeline exports, could force Woodside to pay more to buy in - as much as $US3 billion, or twice the initial amount for a 30 per cent share, on some estimates.

..............Domestic sales will flow first, then regional sales via pipelines and ultimately floating LNG, presumably tapping Shell technology, which Woodside is accessing as part of its own development options for the giant Browse project off the coast of Western Australia.

''All parties are … engaged in negotiations and are targeting a structure that allows us to recognise the increased value that we see coming forth from Leviathan,'' Noble told analysts in this month.

Woodside shareholders can only take these comments on faith because there has been no fleshing out of the impact of the changed project dynamics on the company's proposed participation.

That said, Woodside has said it will only pursue participation if there is upside for its shareholders - a ''compelling value case'' given the size of the proposed investment.

This is a clear case of seeing is believing.

Woodside stake may be split if Shell sells out

ReplyDeleteLONDON (Reuters) - Royal Dutch Shell's 23.1 percent stake in Australian oil and gas group Woodside Petroleum is seen as more likely to be split up and/or sold to institutional shareholders than to go in one piece to a strategic buyer, bankers said.

The holding, worth about $6.4 billion (3.9 billion pounds) and left over from Shell's abortive attempt to acquire Woodside in 2001, has long been viewed as non-core to Shell.

This year, the Anglo-Dutch company promised to accelerate asset sales to reflate a narrowing cushion between cash inflow and investment spending.

Reuters was unable to verify Shell's intentions for the stake. Shell and Woodside declined to comment on its future.

Bankers say the holding is an obvious selloff candidate for incoming Chief Executive Ben van Beurden, who takes the job on January 1 and will offer strategy pointers on January 30 along with fourth-quarter results.

However, they say, other investor-owned international oil companies big enough to buy it are also in selloff mode.

Meanwhile, a strategic buyer such as one of China's top oil companies or the national oil companies (NOCs) of gas-hungry countries such as India or Thailand might be put off by Shell's experience with the Australian government when it tried to take full control of Woodside in 2001.

"Bidder-wise, it's a tricky one," one banker said.

"The deal is big enough to require a review by the government, and although Woodside is not as important as it was at the time when Shell's bid was blocked, it is still the largest independent oil company in Australia, so I don't think the Chinese NOCs would be welcome."

The banker suggested Middle Eastern or Southeast Asian sovereign wealth funds might be interested, but said Shell probably would not find a buyer among them for the entire stake and would have to sell in small blocks.

The banker predicted Shell would exit via a combination of strategic sales, market placements and probably a share buyback by Woodside.

A second banker said the stake as a single block had been "shopped" to a number of potential strategic buyers without result, and predicted the shares would be spread in the market among institutional investors.

LONG HISTORY

Shell's interest in the plentiful offshore gas under Australia's northwest shelf dates back decades and remains strong through its Prelude floating liquefied natural gas (FLNG) project, which will draw gas from below the seabed and process it on board the world's largest vessel.

The company built a 34 percent holding in Woodside as part of that interest. Shell also became, and remains, a partner in the Woodside-operated Browse LNG project, which is set to use Prelude FLNG technology.

In 2001, Shell's attempt to increase its Woodside holding to a majority was blocked by the Australian government on the grounds that the move might slow gas development in Australia.

The country is set to become the world's biggest LNG exporter later in the decade, overtaking Qatar, as a number of major LNG projects come to fruition.

Shell sold a third of its Woodside holding in 2010, reducing that 34 percent stake to the 23.1 percent it holds now.

Blow for Woodside's Browse LNG project as Japanese partners pull out

DeletePlans for developing the multibillion-dollar Browse Basin export gas project have been dealt a blow, with the Japanese partners abandoning a key sales contract that has partially underpinned the project.

Two Japanese trading houses, Mitsui and Co Ltd and Mitsubishi Corp, were planning to buy as much as 1.5 million tonnes of liquified natural gas annually from the project.

However, their participation and the offtake agreement were conditional on a final investment decision being taken for the project to proceed by the end of December, 2013.

But that has been delayed well into 2014, as the partners review development options after abandoning earlier plans to have an onshore processing plant. ‘‘As a result of the Browse joint venture participants deciding not to proceed with an onshore development and to enter Basis of Design for a floating LNG development concept, both parties recognise that this condition will not be satisfied,’’ Woodside said in a statement.

‘‘Consequently, [the Japanese trading houses] has today given Woodside notice terminating the [sales purchase agreement].’’

Even so, the Japanese partners have continued an arrangement to try to market gas from the project into the Asian market.

Shares in Woodside were down 28c to $38.63 in mid-afternoon trading.

...........

Woodside gas sale deal to Japan falls through

Japanese investors have abandoned a deal to buy more than a million tonnes of gas each year from Woodside Petroleum's planned Browse development in Western Australia.

Woodside had two deals with the investment company MIMI - one to jointly market liquefied natural gas in Asia, and one where MIMI committed to buy 1.5 million tonnes of LNG per year off Woodside's Browse development.

The second deal was conditional on a final investment decision on Browse being made by the end of 2013, but Woodside and its partners decided to shelve the previous plan to process the gas onshore and are now investigating floating platform options.

Woodside says MIMI has informed it that it has decided to exercise its right to pull out of the deal.

However, it says the deal for MIMI to jointly market the gas in Asia, particularly to Japanese customers, remains in place.

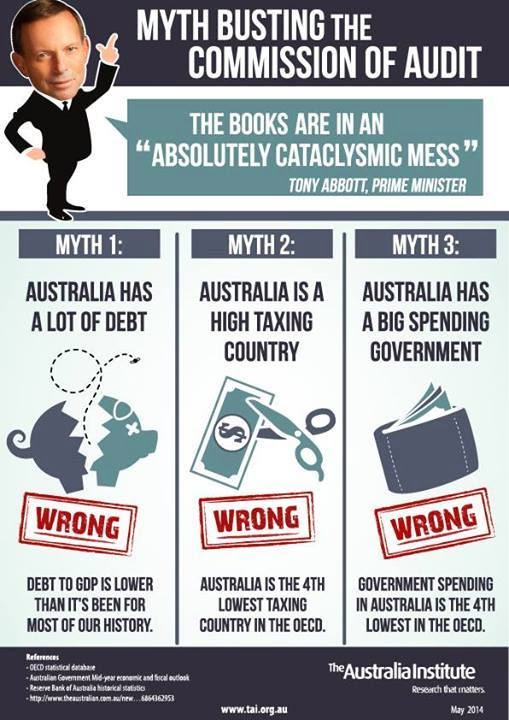

Sh*t happening for Abbott too - and it's being caused by all the sh*t happening to Barnett.

ReplyDeleteElection in west a no-win for the PM

Dennis Shanahan |

The Australian |

December 28, 2013

WITH little prospect of Tony Abbott being able to force - or being prepared to force - a double-dissolution election next year, the result of any new West Australian Senate election is far more important for the new Abbott government than mere electoral failure and voter inconvenience.

At the September 7 election, with federal Liberal Party primary support at an extraordinary 51.2 per cent in Western Australia and Labor's at only 28.8 per cent, the Liberals won three Senate seats, Labor one and independents or the Greens two (depending on the result used).

It is not a question of the balance of power in the Senate; the Coalition will lack a Senate majority from July 1 regardless. It is the degree of hostility of the Senate towards the Abbott government and the difficulty of managing legislation through the upper house. If there is a re-run election, the Liberals have the most to lose because they have virtually maximum seats at risk while Labor has the most to gain with its minimum of one.

Even if the Liberals hold the three spots and Labor picks up only one from the independents, the Liberals will face a more difficult task in garnering support for their legislation because the Labor-Greens bloc will be enhanced and the support of all the Palmer United Party senators and PUP-aligned independents will be needed to pass legislation.

A senator with the sole power to block government plans is in a far more powerful bargaining position than if the government can let one slip.

For this reason, the collapse in Coalition support in Western Australia is potentially disastrous as the Coalition brand suffers from a deeply unpopular state Liberal government.

The Prime Minister's response and Senate campaign, if required, is that the key legislation he wants passed is the repeal of the carbon and mining taxes, which are "anti-West Australian" taxes, and the Senate election would be a referendum on these taxes.

Voters will differentiate between state and federal if the time comes but a bum on a Senate seat is worth two in a ballot.

....

WHICH JUST GOES TO PROVE - ONE MANS SH*T IS ANOTHER MAN'S ROSES.

..

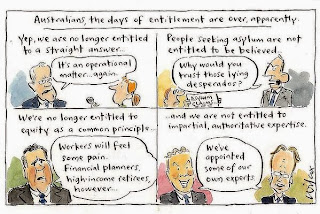

Tony Abbott’s top business adviser accuses IPCC of 'dishonesty and deceit'

ReplyDelete'The scientific delusion, the religion behind the climate crusade, is crumbling,' Maurice Newman says

Tony Abbott’s top business adviser has accused the Intergovernmental Panel on Climate Change of “dishonesty and deceit” as it focuses on “exploiting the masses and extracting more money” in a climate crusade.

Maurice Newman, chairman of the prime minister’s new Business Advisory Council, used an interview with the Australian newspaper to launch a strongly worded attack on the global body that provides advice to governments on the body of scientific findings about climate change.

Newman also argued Australia had fallen “hostage to climate change madness” but he believed the “scientific delusion” was crumbling amid suggestions the global temperature could drop to little ice age levels.

The opposition described Newman as an embarrassment to Australia, saying he was not a scientist and therefore not qualified “to make such outrageous claims”.

“The worst part about Mr Newman’s ignorant comments is that he’s only voicing what we know Tony Abbott thinks about climate change,” said Labor’s acting climate change spokesman, Shayne Neumann.

Abbott established the Business Advisory Council to meet three times a year with senior members of the government and “help guide programmes and policies that are sympathetic to the needs of both small and large businesses in Australia”.

Newman, a former chairman of the Australian Broadcasting Corporation and the Australian Securities Exchange, made the comments about climate change while railing against green policies, including the renewable energy target and the carbon tax.

The newspaper quoted Newman as saying the climate change establishment, through the IPCC, remained “intent on exploiting the masses and extracting more money”.

“When necessarily, the IPCC resorts to dishonesty and deceit,” Newman said.

He said Australia had become “hostage to climate change madness”.

“And for all the propaganda about ‘green employment’, Australia seems to be living the European experience, where, for every ‘green’ job created, two to three jobs are lost in the real economy,” he said.

“The scientific delusion, the religion behind the climate crusade, is crumbling. Global temperatures have gone nowhere for 17 years. Now, credible German scientists claim that ‘the global temperature will drop until 2100 to a value corresponding to the little ice age of 1870’.”

That appeared to be a reference to the work of Horst-Joachim Lüdecke and Carl-Otto Weiss, who say natural processes including solar activity are driving climate change. They are members of an advisory board of the European Institute for Climate and Energy – a group that argues freedom, not the climate, is at risk.

The Australian government’s main scientific advisory body, the CSIRO, says human-induced climate change “represents a raft of new challenges for this generation and those to come, through increases in extreme weather events and other changes, such as sea-level rise and ocean acidification”.

The CSIRO says robust scientific findings include clear evidence for global warming and sea level rise over the past century; most of the global average warming over the past 50 years is very likely due to greenhouse gas increases from human activity; and global greenhouse gas emissions will continue to grow over the next few decades, leading to further climate change.

Tony Abbott’s top business adviser accuses IPCC of 'dishonesty and deceit'

ReplyDeleteIt says some of the key uncertainties include difficulties analysing and monitoring changes in extreme events; and models differ in their estimates of the strength of different feedbacks in the climate system, particularly cloud feedbacks, oceanic heat uptake and carbon cycle feedbacks. The CSIRO says confidence in projections is higher for some variables, such as temperature, than for others, such as precipitation.

The Labor party’s acting climate change spokesman said the extraordinary comments from one of Abbott’s closest advisers proved the Coalition was not serious about taking action on climate change and did not accept the overwhelming evidence of a changing climate.

“The prime minister must ask Mr Newman to withdraw his comments which damage Australia’s relationships with its trading partners, all of whom accept that climate change is real and are taking steps to reduce carbon pollution,” Neumann said.

“Australia is now a laughing stock for being the first country to unravel effective climate change policy, going backwards while the rest of the world is taking steps forward.”

Despite previously questioning climate science, Abbott has repeatedly said he accepts climate change happens and that humanity makes “a contribution to it”. He insists he will be able to achieve a 5% reduction in emissions under his Direct Action scheme and is pushing to repeal Labor’s carbon price package built upon an emissions trading scheme.

The prime minister has previously described Newman as “one of a range of voices that the government takes very seriously”. In November, Newman used a speech to say Australia’s wage rates were high by international standards and workplace reform was needed. He also questioned the affordability of the national disability insurance scheme and the Gonski school funding reforms, acknowledging the causes may be “worthy” but describing the spending as “reckless”.

At the time, Abbott said people would “expect robust advice from someone who amongst many other things is a former chairman of the ABC” but the government would not break its “fundamental commitments to the Australian people”.

Tony Abbott's business adviser says Australia taken 'hostage' by 'climate change madness'

ReplyDeleteTony Abbott should order his top business adviser to withdraw ''ignorant comments'' about climate change policy destroying Australia's manufacturing sector and competitiveness, says Labor.

The scientific delusion, the religion behind the climate crusade, is crumbling

The opposition's acting environment spokesman Shayne Neumann said Maurice Newman's comments ''damage Australia's relationships with its trading partners".

In an opinion piece in The Australian newspaper, the Prime Minister's pick as head of his Business Advisory Council, Maurice Newman, wrote high energy costs caused by the carbon tax and the renewable energy target, introduced under the Howard government, had eroded Australia's competitiveness.

Under Labor and the Greens, Australia had been taken "hostage" by "climate change madness".

Mr Neumann said the comments were ''ignorant''.

"These extraordinary comments from one of Tony Abbott's closest advisers prove the Coalition is not serious about taking action on climate change and does not accept the overwhelming evidence of a changing climate," the Opposition's acting environment spokesman Shayne Neumann said.

"The worst part about Mr Newman's ignorant comments is that he's only voicing what we know Tony Abbott thinks about climate change.''

In the opinion piece, Mr Newman said Australia's manufacturing sector and overall competitiveness have been destroyed by climate change policies driven by "scientific delusion".

"Climate change madness . . . has been a major factor in the decimation of our manufacturing industry," he said.

"It is the unprecedented cost of energy, driven by the Renewable Energy Target and carbon tax, which, at the margin, has destroyed our competitiveness."

Mr Newman added that he believed the green economy was killing Australian jobs.

"For all the propaganda about green employment, Australia seems to be living the European experience, where, for every green job created, two to three jobs are lost in the real economy," Mr Newman said.

"The scientific delusion, the religion behind the climate crusade, is crumbling."

Mr Newman wrote he believed the Intergovernmental Panel on Climate Change resorted to "dishonesty and deceit" and were "intent on exploiting the masses and extracting more money".

Australian Chamber of Commerce and Industry boss Peter Anderson said Mr Newman offered a "very valid overall perspective".

"Australia's competitiveness has been weakened over the past six years, in part because of poor policy responses to climate change," he said.

Mr Anderson said it was not his place to offer opinions on climate science, but he believed Australia's manufacturing sector had been weakened by high energy costs due to the carbon tax and an "overly ambitious" renewable energy target.

Mr Newman is a former chairman of the ABC and the Australian Stock Exchange.

Since being appointed as Mr Abbott's chief business adviser, Mr Newman has provoked controversy with his public statements.

In November, comments by Mr Newman brought the contentious Howard government industrial relations policy of WorkChoices back in the headlines, despite repeated assurances from Mr Abbott that the policy was "dead, buried and cremated".

Addressing the Committee for Economic Development of Australia on November 11, Mr Newman said Australia's industrial relations system must be reformed, even if the idea brings forth ''screams of outrage and the spectre of WorkChoices''.

He said he was speaking in a personal capacity.

''We cannot hide from the fact that Australian wage rates are very high by international standards, and our system is dogged by rigidities," Mr Newman said.

Maurice Newman & Tony Abbott & his government are full of sh*t...............

DeleteBut so was "Old King Coal" from Queensland who was here to help & "The Coal Miners Daughter" who was here to help dig it out the ground.

They are all like Ferguson - a load of ass kissing ass wipes who only want a cushy place on the board of all these companies they corruptly help while in government.

They do not give a sh*t for the rest of us.

Tentative start for offshore cash bidding

ReplyDeleteTuesday, 31 December 2013

David Upton

THE federal government last week revealed its proposed offshore acreage release areas for 2014, with a couple of nice surprises for industry.

The first piece of positive news is that industry demand for exploration acreage in the Great Australian Bight is still not satisfied.

BP began the rush into the central Bight Basin when it picked up four permits (EPP 37, 38, 39 and 40) in January 2011 with a record work program bid.

Statoil was brought in as a 30% joint venture partner in May of this year.

Another three permits were awarded in October – EPP 43 to Santos and Murphy Oil and EPP 44 and 45 to Chevron, in a sign the Bight Basin is a frontier oil play of global significance.

Exploration demand is still running hot.

The proposed 30 release areas for 2014, which are driven by nominations from petroleum explorers, includes a massive area of about 30,000sq.km to the immediate west of EPP43.

It is the first of the new Bight Basin permits to sit off the coast of Western Australia, extending west along the continental slope from the WA/South Australian border for more than 300km.

Offshore acreage releases are managed by the Department of Industry, under Resources Minister Ian Macfarlane.

The department was careful last week to stress that proposed areas could change or be dropped altogether from the actual acreage release at the annual Australian Petroleum Production and Exploration Association conference.

However, the department did state “there was strong participation from industry in the nomination process, with 11 companies nominating over 40 areas for potential inclusion in the 2014 acreage release”.

The second nice surprise from last week’s announcement is the limited size of areas for proposed release under a cash bidding system.

The federal government flagged back in 2012 that it would reintroduce cash bidding in 2014 for areas that are mature or contain known petroleum accumulations.

The decision was met by strong protest from APPEA, arguing that cash bidding “diverts funds from the drilling of wells to the payment of government access charges”.

The industry body also pointed out that cash bidding particularly disadvantaged junior explorers because of their limited budgets.

It said this could have a serious impact on petroleum discovery as juniors were often the ones that blazed trails into new petroleum provinces.

The government argues that cash bidding is a more efficient use of capital in areas that do not need much exploration spending and points out that the system is used successfully in the Gulf of Mexico.

Tentative start for offshore cash bidding

ReplyDeleteIn last week’s announcement, the government revealed that only four of its 30 proposed release areas would be subject to cash bidding.

Furthermore, each of the four release areas is small, ranging in size from approximately 200sq.km to 600sq.km.

The map of proposed cash bidding areas does not show their proximity to known petroleum accumulations but the government appears to have been very selective.

For example, in the Carnarvon Basin the government is proposing the release of 16 areas, of which only three will be subject to cash bidding.

In the Browse Basin, eight areas are proposed for release, with only one area subject to cash bidding, in close proximity to the giant Ichthys gas/condensate field.

These signs suggest government is in fact serious about promoting cash bidding as a more efficient auction process in proven areas, rather than revenue raising.

Looking more generally across the proposed release areas in the Carnarvon Basin, it is clear that explorers are eager to secure any available acreage in Australia’s premier hydrocarbon basin.

All of the 2014 areas pencilled in for the Carnarvon Basin are limited in size and represent little more than in-fill between larger, neighbouring permits.

Further north in the less mature Browse Basin, the new opportunities for explorers are more expansive.

The proposed release for 2014 includes four areas of substantial size in the central and northeast parts of the basin.

The most central of these four permits is to the immediate northeast of the Ichthys field.

Another three proposed areas lie in the Territory of the Ashmore and Cartier Islands.

These are located west of and surrounding the Montara and Skua oilfields and the Crux gas/condensate field.

Further north, another proposed area lies in the Bonaparte Basin in the vicinity of the Bayu-Undan gas field.

The high level of exploration interest in Australia’s northern waters continues about 300km to the east, with three areas proposed in the vicinity of the Caldita and Barossa fields.

Drilling activity at these fields is being revived almost a decade after their discovery.

The fields have a high carbon dioxide content and were not seen as attractive options for alternative feedstock for Darwin LNG.

However, ConocoPhillips, which is operator of Caldita/Barossa and Darwin LNG, has brought in a new partner in SK Group.

The South Korean company is earning a 37.5% interest from ConocoPhillips and Santos by funding a three-well appraisal program at a cost of $US260 million ($A292 million).

The 2014 release is rounded off by a large proposed area in the Petrel sub-basin of the Bonaparte Gulf.

The area extends northwest of WA-488-P, awarded last year to MEO and west of MEO’s WA-454-P, where Origin Energy is earning a 50% interest at a cost of about $A40 million.

The gas potential of the Petrel sub-basin has come into focus with this deal and the nearby proposed development by GDF Suez and Santos of the Petrel, Tern and Frigate fields via floating LNG.

ENP : http://www.energynewspremium.net/StoryView.asp?StoryID=801875804